If there is an amount in box 2d in-clude that amount on line 4 of the 28 Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D. However if you are filing Form.

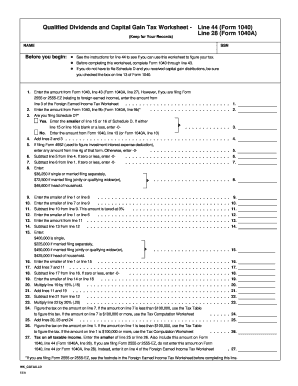

Qualified Dividends And Capital Gain Tax Worksheet 2019 Fill Out And Sign Printable Pdf Template Signnow

Keep for Your Records.

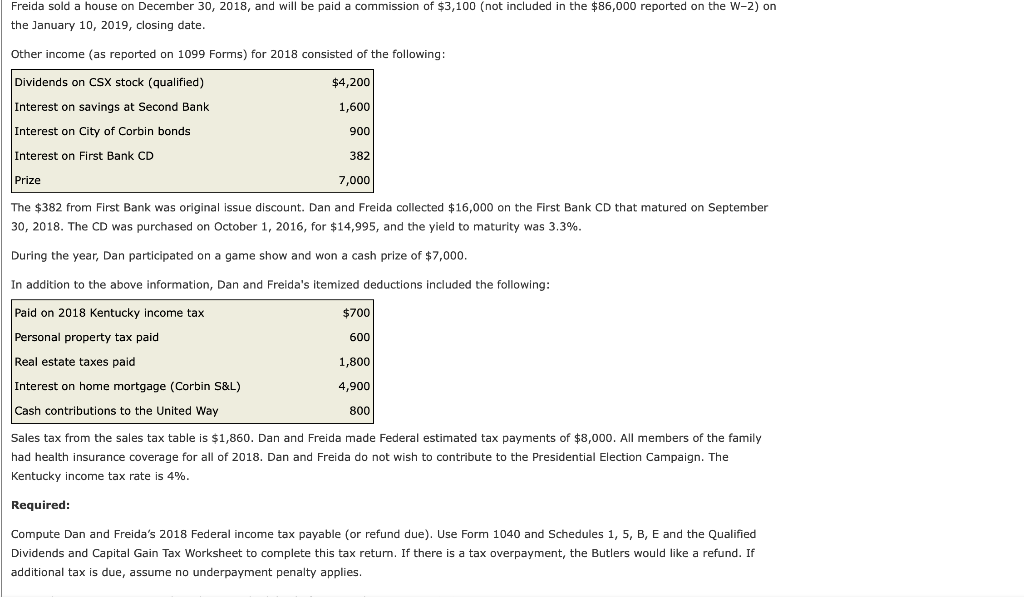

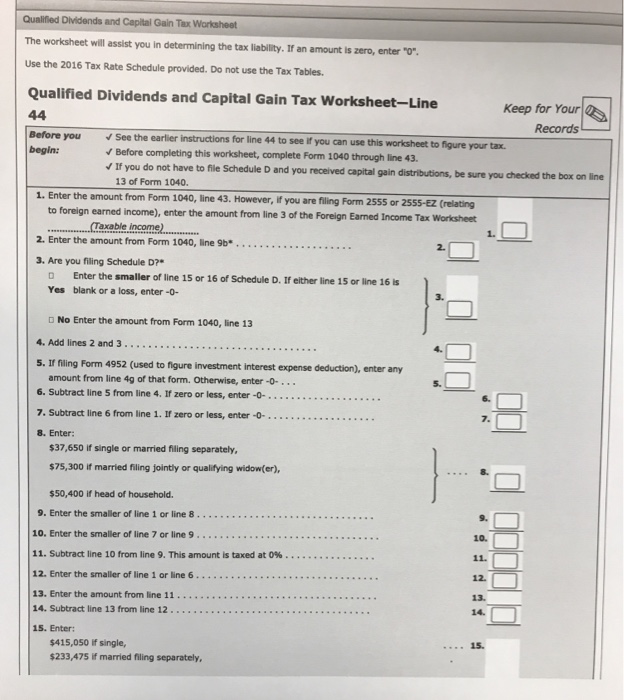

2019 qualified dividends and capital gains worksheet. On Form 1040 or 1040-SR line 6. A 15 of 479000 or 71850 plus b 20 of the difference between 700000 and 479000 or 44200 plus c the tax on 200000 taxable income that is neither qualified dividends nor capital gains or 36579. Select the Get form key to open it and start editing.

This free spreadsheet enables just about anyone to use Microsoft Excel to prepare and print their entire 1040 return. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.

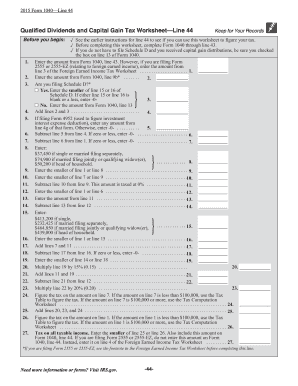

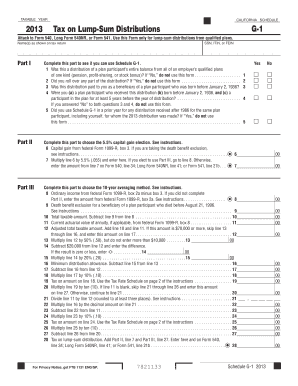

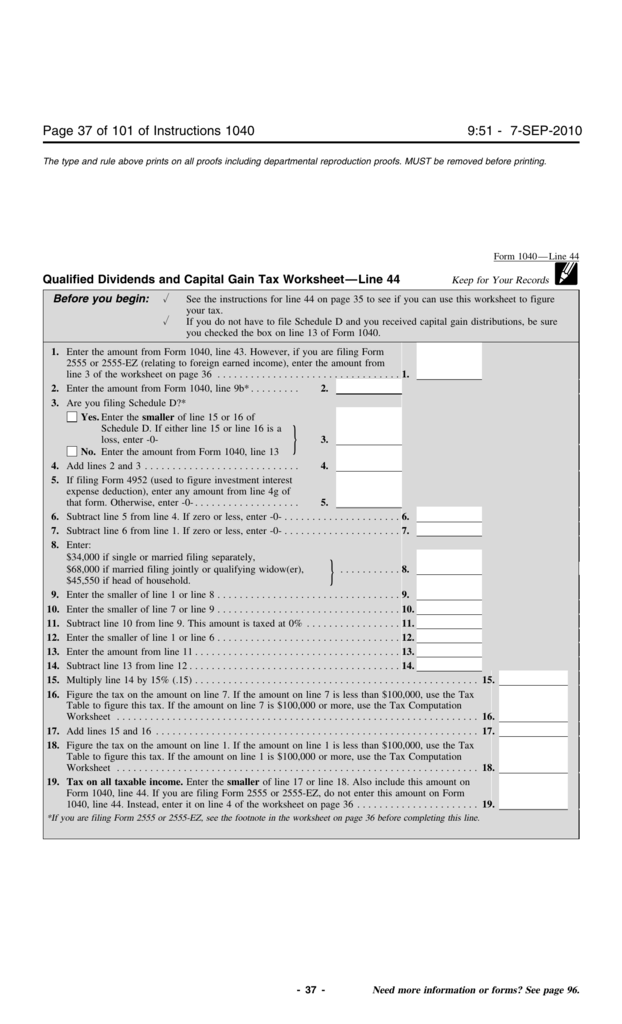

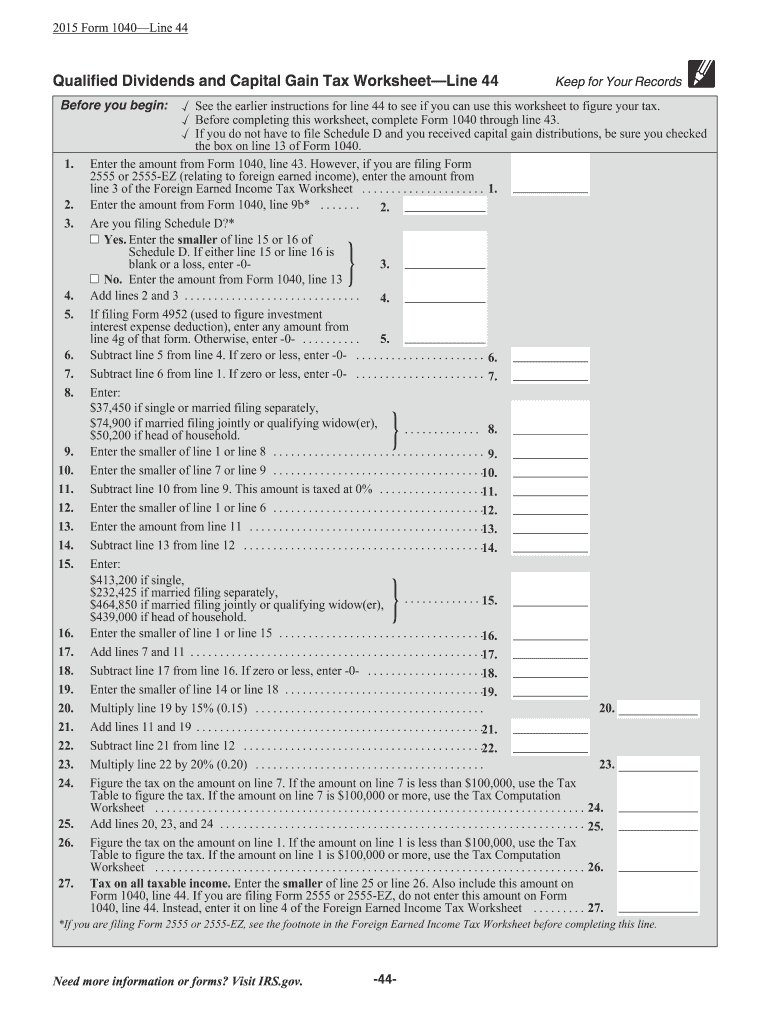

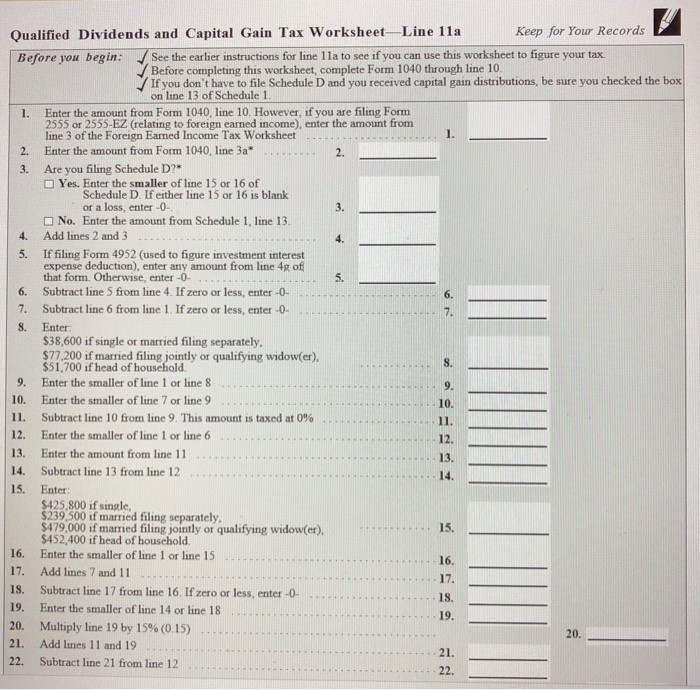

Qualified Dividends And Capital Gains Worksheet 2019. In those instructions there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet which is how you actually calculate your Line 44 tax. Fill in all of the requested fields they are marked in yellow.

If you received capital gain distribu-. Fill out securely sign print or email your qualified dividends tax worksheetpdffillercom 2015-2020 form instantly with SignNow. Displaying top 8 worksheets found for - 2019 Qualified Dividends And Capital Gain Tax.

Qualified Dividends and Capital Gain Tax Worksheet. Qualified dividends or a net capital gain for 2019. 2019 Qualified Dividends And Capital Gains Displaying top 8 worksheets found for - 2019 Qualified Dividends And Capital Gains.

2020 Instructions for Schedule DCapital Gains and Losses. Excel-based versions of Form 1040 are available for all years from 1996 through 2008. See the Instructions for Form 1041-N at.

The form calculates the taxable earnings of a taxpayer and then determines just how much is payable or refunded towards the government via taxes. Some of the worksheets for this concept are 2019 form 1041 es 44 of 107 Fo if 2019 2018 form 1041 es Table of contents 2018 form 1040 es Tax strategies 2017 qualified dividends and capital gain tax work. So for those of you who are curious heres what they do.

Qualified Dividends And Capital Gains Worksheet 2019 Line 12a. Along with the actual forms the spreadsheet includes some IRS documentation as well as links to download official IRS forms and instructions. Qualified Dividends and Capital Gain Tax WorksheetLine 11a.

If you do not have to file Schedule D and you received capital gain distributions be sure you checked. This is actually the biggest class of forms in IRS. Now working with a Qualified Dividends And Capital Gain Tax Worksheet 2019 takes a maximum of 5 minutes.

Our state web-based blanks and clear guidelines eliminate human-prone errors. Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly. Before completing this worksheet complete Form 1040 through line 10.

December 16 2020 Others IRS Form 1040 Qualified Dividends Capital Gains Worksheet Form 1040 Form is an IRS needed tax form needed from the US government for federal income taxes filed by citizens of United States. Income Tax Return for Electing Alaska Native Settlement Trusts as a worksheet to figure the 2019 tax on qualified dividends or net capital gain. The 27 lines because they are so simplified end up being difficult to follow what exactly they do.

Use Part IV of Schedule D of Form 1041-N US. The box on line 13 of Form 1040. 2019 Form 1040 Qualified Dividends And Capital Gain Worksheet Form 1040 Tax Return is a vital IRS tax return form utilized by all US taxpayers to file their taxes within the year they are because of.

Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below. October 9 2020 by admin. Exclusion of Gain on Qualified Small Business QSB Stock later.

Following this example there is a simple way to calculate the tax. Find the document template you need from our collection of legal form samples. Before completing this worksheet complete Form 1040 or 1040-SR through line 11b.

Main idea worksheets ereading worksheet qualified dividends and capital gains accounting writing linear equations answer report folders walmart child support az tax 2019 redox reactions. Some of the worksheets for this concept are 2019 form 1041 es 44 of 107 Qualified dividends and capital gain tax work 2018 2018 form 1041 es 2018 estimated tax work keep for your records 1 2a 2018 form 1040 es 2017 qualified dividends and capital gain tax work State of south carolina i 335. Available for PC iOS and Android.

Pick the web sample from the catalogue. With 700000 in both qualified dividends and capital gains the tax should be. Qualified Dividends and Capital Gain Tax The information from Form 1099-DIV Dividends and Distributions and Form 1099-B Proceeds From Broker and Barter Exchange Transactions can easily be entered into the TaxAct program in the Investment Income section of the Federal QA or directly on the forms where applicable.

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Enter the amount from Form 1040 line 43. Before completing this worksheet complete Form 1040 through line 43.

Tax Loss Harvesting At Vanguard A Primer The White Coat Investor Investing Personal Finance For Doctors Tax Loss Finance

Capital Gains Tax Worksheet Promotiontablecovers

Qualified Dividends And Capital Gain Tax Worksheet Line 44

Youtube Common Core Math Worksheets Math Worksheets Free Printable Math Worksheets

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Tax Questions

Capital Gains Tax Worksheet Promotiontablecovers

2019 Form 1040 Qualified Dividends And Capital Gain Tax Worksheet 2021 Tax Forms 1040 Printable

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Iras Internal Revenue Servic Social Security Benefits Irs Tax Forms Tax Forms

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 Fill Online Printable Fillable Blank Pdffiller

Capital Gains Tax Worksheet Promotiontablecovers

What Is An Insurance Declaration Page All About The Dec Page Insurance Content Insurance Personal Finance Advice

How Your Tax Is Calculated Understanding The Qualified Dividends And Capital Gains Worksheet Marotta On Money

Instructions Schedule Schedule 5 Qualified Dividends Chegg Com

Create A Function For Calculating The Tax Due For Chegg Com

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

How Are Capital Gains And Dividends Taxed Differently

Tax Implications Of A Dividend H R Block

In C Please Create A Function To Certify The Chegg Com

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Form 1040 Is One Of Three Irs Tax Forms Used For Personal Federal Income Tax Returns Filed With The Internal Revenue Irs Tax Forms Irs Taxes Federal Income Tax

No comments: